From Zero To Profitable Trader

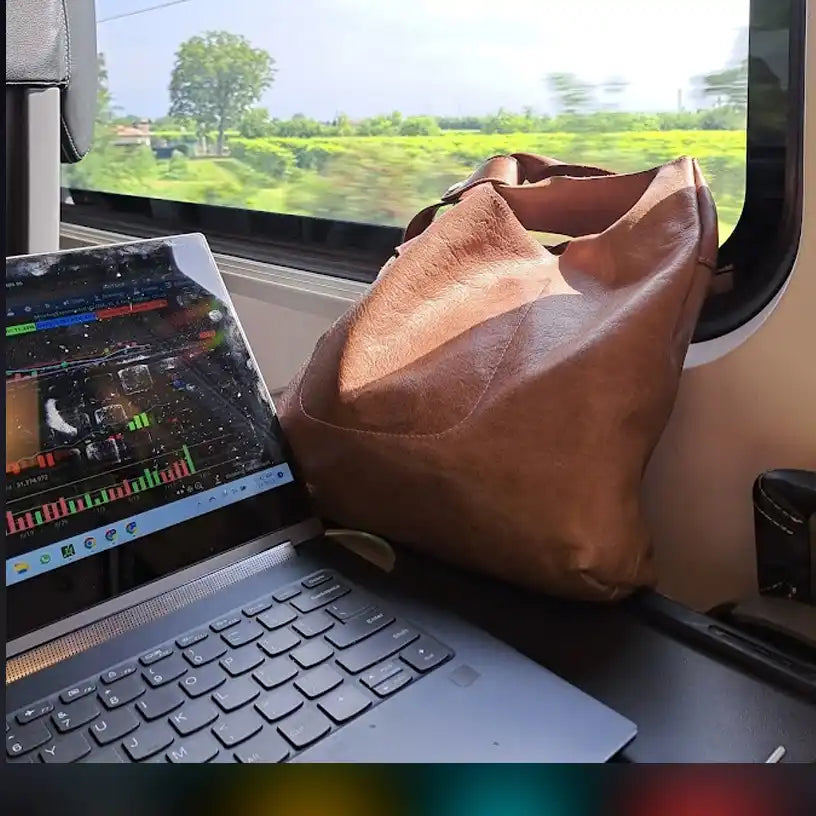

Unlock Your Path to Financial Freedom through Options Trading.

Learn from Experienced Full-Time Traders

Imagine turning a small amount of knowledge into meaningful gains. When we started trading six years ago, we knew almost nothing—yet within our first month, we earned $12,843 trading options. It was a game-changer, and we’ve been refining and mastering these skills ever since.

Options trading might sound complex, but there are basic strategies that most investors can use to generate weekly income. This program is designed to take you from Zero to Profitable Trader without spending all your time infront of your computer watching candle sticks go up and down.

What you will learn

This program will equip you with everything you need to succeed in Options trading, including:

- Stock Trading Fundamentals: Understand the essentials and build a strong foundation.

- Mastering Options: Gain a thorough understanding of PUTs, CALLs, and options trading techniques.

- Income-generating Options Strategies: Strategies to fit your goals and lifestyle.

- What to do and more Importantly, what not to do: Most traing programs will give you a high level overview of what to do, in trading its more important to know what not to do, and this is what you will get from this course.

What does the online-course cover

GET TO KNOW THE MARKET

- What are the Nasdaq, Dow and S&P?

- Bears and Bulls

- Forces that move the market

- Which stocks to trade options on and which not to

MULTIPLE WAYS TO MAKE MONEY TRADING

- Buy and Hold

- Day or Swing Trading

- Dividends

- Options

HOW TO ACCESS THE MARKETS

- Preferred Brokers

- What Type of Account Should I Apply For and Why?

- Setting up a paper money account

TECHNICAL ANALYSIS

- Supply and demand zones

- Trend lines

- Technical indicators (we share what we are using)

- Understanding the Greeks

- Volume

OPTION TRADING BASICS

- Why Options?

- Stocks vs Options

- Difference between buying and selling options

- Put / Call Leverage:

Buying a Long Put

Buying a Long Put - Debit Spreads:

Buying a Bull Call Spread

Buying a Bear Put Spread - Credit Spreads:

Selling a Bull Put Spread

Selling a Bear Call Spread - Neutral Strategy:

Iron Condor

Reverse Iron Condor - What is Rolling a Trade?

DEFINED RISK INCOME STRATEGIES

- Buying a Call

- Buying a Put

- Put Verticals

- Call Verticals

- Iron Condor

REALISTIC REVENUE OUTLOOK

- How much do you need to trade options

- How much can you make per week, we'll show you on a sliding scale of $1000-$500,000

- How do you scale your revenue

TRADER PSYCHOLOGY

The trader mindset? This will not mean anything to you right now, but once you become a trader it will impact everything.

BONUS: LIVE Q&A SESSIONS

After this course, you will have questions; it's normal. We will host 4 live one-hour group Q&A sessions after you complete the course. Here you can ask us anything related to the course, a simulated trade you've done or considering or help on rolling a trade.

INDUSTRY TOOLS TO HELP YOUR LEARNING CURVE

What tools and books can help

Straight Talk

But let’s be clear—trading isn’t a get-rich-quick scheme. It involves both risks and rewards. Our approach will teach you to navigate these ups and downs, equipping you with strategies for smart, informed decision-making.

Are You Ready to Commit?

This course isn’t for those looking for a magic button to press for overnight riches. We’re only work with committed individuals ready to invest at least 3-6 months in hands-on training. Paper trading with $100,000 in simulated funds, and mastering a skill set that has the potential to change your life.

Spaces are limited, so apply today and take the first step toward financial freedom.

JOIN THE WAITING LIST TODAY, YOUR FUTURE SELF WILL THANK YOU.