3 Steps to Generational Wealth for the global majority

Share

In my global travels, I've had the privilege of meeting extraordinary individuals, each one offering unique lessons about life. In our everyday encounters, some teach me about gratitude, some about humility. Others teach me about the value of family or inspire me with their own stories from different parts of the world. These lessons, stories, or experiences are universal, regardless of color, background or affluence.

However, one topic that often remains within racial boundaries is generational wealth.

I often have to silence the chip on my shoulder when my white friends talk about paying off student debt or buying their first home or car with inheritance from a grandparent. Or, struggling with the decision of whether to sell or to live in their parents’ home after they pass.

I could never join in this conversation, in fact I often struggled to understand their perspective, because no one in my family - or any of my black and brown friends, for that matter - ever had such a windfall or expected to get one.

Perhaps because of that I’m determined that my children will have a different experience. And I’m hoping that you share the same desire for your children.

What is Generational Wealth and Why does it matter?

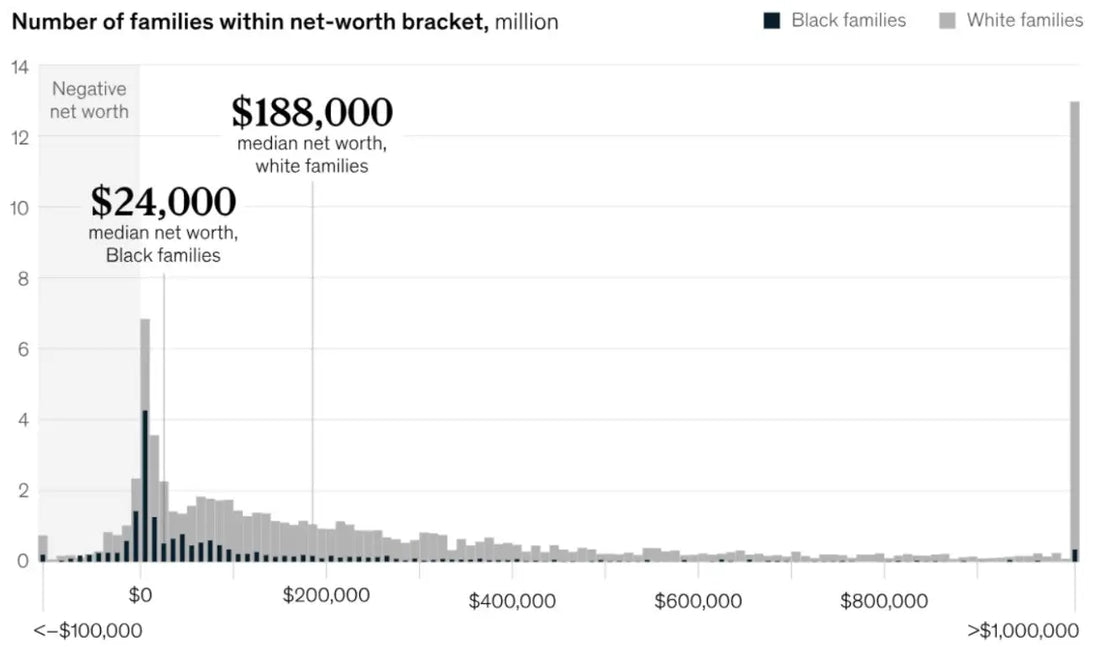

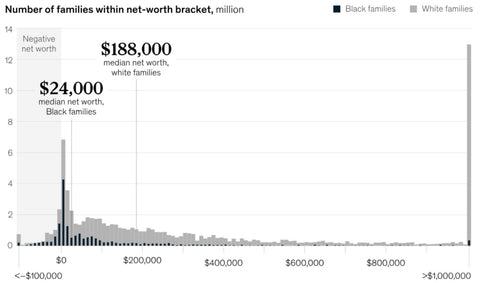

Wealth is the difference between what families own—for instance, cash in their savings and checking accounts, retirement savings, and assets such as houses, and cars—and what they owe on credit cards, student loans, and mortgages, among other debt.Generational wealth refers to the wealth passed down through families to children, grandchildren and beyond.

Much has been written on the wealth disparity that exists between different racial groups in the USA, so I won’t go into it here, but it’s worth reading the article I linked below.

So much is needed to even bring on par the racial disparity in generational wealth. Huge systemic changes are required in healthcare, housing, education, tax policy and banking.

As these huge changes take time and can sometimes feel insurmountable, I want to focus on the steps every one of us can take to start narrowing this gap and build our own generational wealth - today.

A legacy more valuable than money

Here are 3 important steps that you can take today to start building generational wealth for your family.

1. Get in the right space

This is undoubtedly the most important step to take to set yourself up for success.

- Headspace: Your mindset is a powerful thing; it affects everything you think and see. What you create and achieve in your life depends on it. Make time in your day for simple habits that will have a profound impact on your life, like journaling, meditation, planning, and dreamcasting.

- Health: You cannot enjoy your wealth without your health. Take care of your body. Eat well and exercise regularly.

- Physical space: Your circles of influence impact so much more than you may think. Be aware of who you know and where you spend your time. Change your physical space whenever possible and expand the circle of people around you. Use the 6th degrees of separation principle to tap into possibilities that otherwise would not exist.

2. Understand money

Generational wealth is often lost due to a lack of financial literacy. We're not taught about generational wealth. We either have it or we don't.

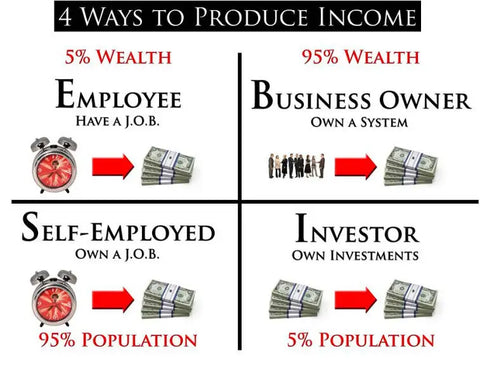

There are 4 different ways to produce income. Each of these has a big impact on how you build generational wealth and how long it takes. Have a look at each option and consider how much time you trade for money and how fast you can get your money to work for you.

- The Employee trades time for money. They are paid a defined amount of money for executing a task for a defined period of time. All of us begin earning money in this way and most of us never do anything else.

- The Self-Employed begins to control when they will work and for how long, but this ‘time’ is in direct relation to the amount of income that can be produced. For example, I could teach a yoga class but am only paid if I am present for the entire class.

- The Business Owner owns a system that is able to produce more wealth with the same amount of time. This is a more efficient way to build wealth, however, is typically very time-consuming.

- The Investor lets their money work for them. Income potential is not related to the amount of time the investor works. If planned correctly, income is produced even when no work is done. This is how the rich make money.

3. Knowledge acquisition

Find your passion and find a way to monetize it - never stop learning. Malcolm Gladwell says It takes 10 000 hours to become an expert at almost anything. Even if this figure is not 100% accurate, it’s still true that you can master just about any skill with about 10 years of deliberate practice.

So, in an average working lifespan of 50 years, we could become experts in 5 different areas. All we need to do is begin.

Other important concepts to understand and use wisely:

-

Reduce your debt:

The average American holds a debt balance of $96,371, according to 2021 Experian data, the latest data available. This debt includes mostly items like car loans, student debt, credit cards and mortgages.

Average interest rates for credit cards are around 24% per year. That means that for every $1,000 you put on your credit card you’ll pay the bank an additional $240 with your repayments. The quickest way to increase your wealth is to reduce your interest payments by paying off debt sooner. -

Inflation:

As of May 2023 the US Inflation rate is at 4.05% (down from its high of 9.06% just 12 months ago). We are all losing buying power every month without even knowing it. That happens because the prices we pay for goods and services are increasing. Our money buys less. -

Credit cards:

There is a way that you can and should use your credit cards to your advantage. As long as you’re disciplined enough to repay the full balance each month, most credit cards offer benefits that far outweigh any annual fee. Examples include cash-back, travel benefits, insurance benefits, etc. Learn how to travel the world without paying for flights or accommodation. -

Using other people's money:

Your credit score is an extremely important number if you’re living in the USA. Use credit cards wisely to increase your credit score without paying any interest. -

Stock Market:

Find out more about how you can make money like rich people do. It’s possible for everyone. -

Compound interest:

If we can encourage our children to save or invest just 1% of their income from the day they start working, compounding interest will help them pay off mortgages and student debt in record time. Use high-interest savings accounts to grow this even faster. -

Live below your means

This means putting more value on your long-term plans than on societal expectations. Look at some expense categories you can eliminate or reduce to boost your savings.

Here are a few ideas to get you started: - Housing– consider getting a roommate or moving in with family.

- Cell phone– switch to a less expensive plan.

- Transportation– Swap out Uber/Lyft rides for public transportation.

- Wifi– Share with a neighbor and split the bill.

- Eating out and entertainment– Put a cap on what you are willing to spend each pay period for take-out food.

This informative article from McKinsey Global Institute in June 2021 is a great starting point that explains the widening of an already sharp racial gap in generational wealth (and ultimately life expectancy) in the USA.